Реферат: Налогообложение Резидентов и Неризидентов в Казахстане

b) The second kind of fiscal policy - non-discretion, or policy of the automatic (built - in) stabilizers. The automatic stabilizer - economic mechanism, which without assistance of the state eliminates an adverse situation on different phases business cycle. Basic built - in stabilizers are tax receipt and social payments that are carried out by the state.

On a phase of rise, naturally, the incomes of firms and population grow. But at the progressive taxation the sums of the taxes increased even faster. In this period the unemployment is reduced, well being of needy families is improved. Hence, decrease the payments of the unemployment benefits and others social expenditures of the state. In a result the cumulative demand is reduced, and it constrains economic growth.]

The tendency of transfer payment spending to rise during recessions and fall during expansions results from the bases on which people qualify to receive these payments. People qualify to receive welfare programs only if their income falls below a certain level. They qualify for unemployment compensation by losing their jobs. When the economy expands, incomes and employment rise, and fewer people qualify for welfare or unemployment benefits. Spending for those programs therefore tends to fall. When economic activity falls, incomes fall. people lose jobs, and more people qualify for aid, so spending for these programs rises.

Taxes affect the relationship between real GDP and personal disposable income they therefore affect consumption expenditures. They also influence investment decisions. Taxes imposed on firms affect the profitability of investment decisions and therefore affect the levels of investment firms will choose. Payroll taxes imposed on firms affect the costs of hiring workers; they therefore have -impact on employment and on the real wages earned by workers.

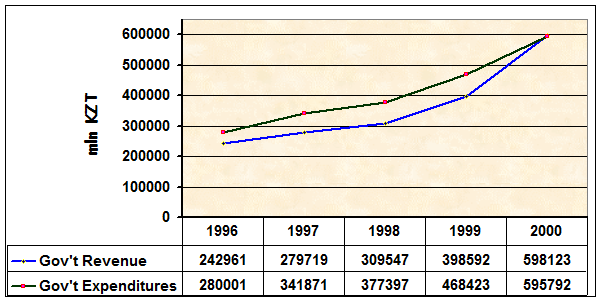

Exhibit below compares government revenues to government expenditures since I996. We see that government spending in Kazakhstan has systematically exceeded revenues, revealing an underlying fiscal deficit between 4 percent and almost 9 percent of GDP, entailing substantial public sector borrowing requirements. Until 1994, fiscal deficit had essentially financed through monetary expansion by the Central bank, with a highly detrimental effect on the rate of inflation during the period. Since then, the National Bank of Kazakhstan has adopted a more independent monetary policy, and fiscal deficits have basically financed either by the proceeds from privatization of state assets or by borrowing foreign loans.

Sources: Statistics Agency of RK, 2001

On a phase of crisis tax receipts automatically fall and reduced the sum of withdrawals from the incomes of firms and households. Simultaneously grow payments of social character, including unemployment benefit.

At result the purchasing power of the population is increased, that helps to overcoming recession of economy.

From mentioned above it is visible, how large place occupies taxation in financial regulation of macroeconomic. So we can conclude that the main direction of fiscal policy of the state is improving the legislations and practice collection of tax.

Let's take example for the most important version of the taxes – the income tax, which is established on the incomes of physical persons and on profit of firms. How the size of this tax is defined (determined)?

First is counted the total income - sum of all incomes that are getting by the physical and legal entities from different sources. From the total income by the legislation it is usual it is authorized deduct: 1) industrial, transport, the travelers and advertising expenditures; 2) various tax privileges (free minimum of the incomes; for example, in USA in 1990 this minimum was 2050 dollars; the sums of the donations, privilege for the pensioners, disable people etc.). Thus, taxed income is a difference between the total income and the specified deductions.

It is important to establish optimum tax rate (size of the tax on unit of taxation). The following rates of the tax differ:

· hard, which are established on unit of object independently on its cost (for example, motor vehicle);

· proportional, i.e. uniform percent(interest) of payment of the taxes independently on the sizes of the incomes;

· progressive, growing with increase of the incomes.

The practice shows, that at the extremely high rates of taxes discourages to work and to the innovation. Sharp increase in 60-70-е years in western countries of tax burden has resulted the negative consequences. It has caused " Tax revolts ", wide evasion from the taxes, promoted outflow of the capitals and flight of the addressees of the high personal incomes in the countries with one lower level of the taxation.

As it is known, in 70’s neo-conservators have put forward the theory of Supply. Its authors have established, that growth of the taxation renders adverse influence on dynamics of manufacture and incomes. Increase of the taxes at the expense of increase of their rates on certain stage does not compensate reduction of receipts in the state budget because of fast narrowing taxed incomes, and then it can be accompanied also by reduction of total sums of the budget incomes. In a result the high taxes render constraining influence on the offer of the capital, work and savings.

Basic task of economic policy representatives of the theory of Supply consider determining the optimum rates of taxation and both tax privileges and payments. Decrease (reduction) of the taxes is considered as a means capable to ensure Long-term economic growth and struggle with inflation. It will strengthen aspiration to receive huge incomes, will render the stimulating influence will increase by growth of production.

1.2 Taxation

As required by the Constitution of Kazakhstan, within the tax system of Kazakhstan, any taxes, levies, and other obligatory payments may be established only by the laws enacted by the Parliament of the Republic of Kazakhstan. Parliament may not delegate its constitutional powers to establish the tax system, taxes or levies, and sanctions for tax violations to the government or any other authority. Under the Constitution, laws in general and tax laws in particular enter into effect after the President signs them.

Tax legislation of the Republic of Kazakhstan consists of the Tax Code and Normative Legal Acts, and is regulated by International Agreements. Tax legislation is based on the principles of the mandatory nature of payment of taxes and other mandatory payments to revenue, certainty and equity of taxation, unity of the tax system and publicity of tax legislation. The Tax Code of the Republic of Kazakhstan establishes Kazakhstan taxes, levies, and general tax principles. A tax takes largest share of budget revenues (Appendix A).

Companies formed in Kazakhstan under Kazakhstan law are taxed on world-wide income. Income earned by a foreign company or person through a permanent establishment in Kazakhstan is taxed in Kazakhstan. Branches of foreign entities are taxed on Kazakhstan source income (where services are performed, not where paid for). Income from a Kazakhstan source to a non-resident and not related to a permanent establishment, is taxed at the source of the payment, and further, on the total income without deductions, excluding labor that is taxed as personal income.

Double Tax Treaties In December 1996, a treaty on the Avoidance of Double Taxation between the United States and Kazakhstan came into force. A number of treaties on the avoidance of double taxation were ratified in 1998. This includes agreements with the following countries: the Czech Republic (November 1998), France (November 1998), Sweden (July 1998), Bulgaria (July 1998), Turkmenistan (July 1998), Georgia (July 1998), Republic of Korea (July 1998), Germany (November 1998), and Belgium (November 1998).

Kazakhstan has double tax treaties with more than 20 countries, which generally follow the OECD Model Income Tax Convention.

| Withholding Tax Rates for Treaty Countries | |||||||

| Dividends | |||||||

| Major Rate (%) | Legislative Rate (%) | Major Holding (%) |

Interest (%) | Royalties (%) | |||

| Azerbaijan | 10 | 15 | - | 10 | 10 | ||

| Belarus | 15 | 15 | - | 10 | 15 | ||

| Bulgaria | 10 | 15 | - | 10 | 10 | ||

| Canada | 5 | 15 | 10 | 10 | 10 | ||

| Czech Republic | 10 | 15 | - | 10 | 10 | ||

| Germany | 5 | 15 | 25 | 10 | 10 | ||

| Hungary | 5 | 15 | 25 | 10 | 10 | ||

| India | 10 | 15 | - | 10 | 10 | ||

| Iran | 5 | 15 | 20 | 10 | 10 | ||

| Italy | 5 | 15 | 10 | 10 | 10 | ||

| Kyrgyzstan | 10 | 15 | 10 | 10 | |||

| Lithuania | 5 | 15 | 25 | 10 | 10 | ||

| Mongolia | 10 | 15 | - | 10 | 10 | ||

| Netherlands | 5 | 15 | 10 | 10 | 10 | ||

| Pakistan | 12.5 | 15 | 10 | 12.5 | 15 | ||

| Poland | 10 | 15 | 20 | 10 | 10 | ||

| Russia | 10 | 15 | - | 10 | 10 | ||

| South Korea | 10 | 15 | 10 | 10 | 10 | ||

| Sweden | 5 | 15 | 10 | 10 | 10 | ||

| Turkey | 10 | 15 | - | 10 | 10 | ||

| Ukraine | 5 | 15 | 25 | 10 | 10 | ||

| United Kingdom | 5 | 15 | 10 | 10 | 10 | ||

| United States | 5 | 15 | 10 | 10 | 10 | ||

| Uzbekistan | 10 | 15 | - | 10 | 10 | ||

| * Belgium | 5 | 15 | 10 | 10 | 10 | ||

| Georgia | 15 | 15 | - | 10 | 10 | ||

| Iran | 5 | 15 | 20 | 10 | 10 | ||

| Mongolia | - | - | - | - | - | ||

| Rumania | 10 | 10 | - | 10 | 10 | ||

| Turkmenistan | 10 | 15 | - | 10 | 10 | ||

| France | 5 | 15 | 10 | 10 | 10 | ||

| Czech Republic | 10 | 15 | - | 10 | 10 | ||

| South Korea | 5 | 15 | 10 | 10 | 10 | ||

|

a. Source: Guide on Taxation and Investment in Kazakhstan in 2002, Deloitte & Touche Notes: *double taxation treaties with 9 countries listed below are ratified only by Kazakhstan. | |||||||