Топик: Crisler Corporation. Senior thesis

· Decreased R&D expenses per production unit

· Confluence of technologies of both firms

· Double strength in total

· Opportunities in new markets

· Decrease in price of materials bought from suppliers

Opportunities in new markets

Both Chrysler Corporation and Daimler-Benz operate in quite saturated markets (in terms of their current products). In order for them to grow, they will have to carry on those overseas markets, which means development of products in accordance with preferences of the new markets.

Developing new products for a different market segment or establishing an additional brand might have implications for the positioning of the existing product range. Penetration into completely new market segments for both companies would involve both high costs (new offices, stores, and advertisement programs) and substantial risks for the companies.

Another method for successful penetration and establishment in new markets is co-operation with another manufacturer who already has a successful brand and products in place in the segments where it is represented. In this way, the existing product portfolio could be broadened without any risk to each company’s brand identity and its associations of exclusiveness.

Daimler-Benz is well-known and recognized in Europe and USA for its high-quality cars and has firm customers; however, the opportunities are limited. The newly industrializing countries in Latin America and Asia, on the other hand, offer good prospects for growth—starting from a low level—to the premium products segment. To penetrate these fast-growing markets on any scale, however, it would be necessary to launch new, low-priced products, possibly combined with the creation of a new brand name. The new direction will certainly require new funds and the company might not be able to handle this hard task alone. Another possible problem of penetrating the new markets in Latin America and Asia is, was the establishment of new offices, stores, research of new customer’s’ tastes, and advertisement. To cope with this obstacle to its success, DaimlerChrysler seeks companies in those areas for possible merger, like Daywoo, Mitsubisi and so forth.

Chrysler has not penetrated the European market very deeply. It certainly will be a good opportunity for Chrysler Corporation to start cooperation with Daimler-Benz in order to penetrate the European market without additional costs for opening its offices and stores.

At the same time, Chrysler has very a good market in North America and can facilitate Daimler-Benz’s deep penetration into that market with a new program of minivan production.

Decrease in Price of Materials Bought from Suppliers

One major benefit of the merger is that both companies can save lots of money on external purchases. First, saving will take place in purchasing raw materials from suppliers. Before the merger, both companies had to buy from supplier separately. Everyone knows this law of the market: “the more you buy, the less you have to pay.” Now the companies purchase everything together and the quantity of one batch is doubled, this bad led to significant decrease in price on per-unit basis. For example, DaimlerChrysler already saved $1.4 billions in 1998. In turn, decreases in price for raw materials will provide lower prices for the cars in total and increase compatibility of the new company.

Decrease in R&D expenses per production unit

Another positive aspect of the merger is that both of the companies can combine their efforts in researching and developing new products. Before the merger each of the companies had to conduct research for itself and these costs were spread on per unit basis among all products. Now these costs are spread on a significantly larger quantity of products, which allows decreasing costs of the research and development per every production unit. In addition, intellectual powers of both companies will now work for one huge company—DaimlerChrysler. This factor will bring new, combined ideas into the new company.

Facts:

“On April 17, 2000, DaimlerChrysler announced a new Virtual Reality Center in Sindelfingen, Germany. The Company estimates the new facility will reduce costs of making Mercedes-Benz prototype models by up to twenty percent a shorten product development times while improving quality.”

Confluence of Technologies of Both Corporations

Both of the companies have their own advantages, in terms of technological development. Now, when all these advantages represent one solid company, the new company has more chances for surviving in the car manufacturing industry. The following are evidences of recent innovations in DaimlerChrysler.

“DaimlerChrysler researchers in Ulm, Germany, have developed an infrared-laser night vision system that significantly increases a driver’s visibility at night. The system allows drivers to recognize darkly clothed pedestrians and cyclists even at great distances. It also illuminates the road ahead over a distance of around 500 feet without blinding the drivers of oncoming vehicles.

The system functions as follows: two laser headlights on the vehicle’s front end illuminate the road by means of infrared light that is invisible to the human eye. A video camera records the reflected image, which then appears in black and white on a screen located directly in the drivers’ field of vision, or else as a so-called head-up display on the windshield.”(Auburn Hills, April 5, 2000)

Double Strength of New Corporation

One of the factors that investors are looking for before making their investment decision is a company’s overall stability. Usually the large corporations are considered to be stronger than small ones.

The new size of DaimlerChrysler might lead to more stability, which in turn could mean lower rates of return required by investors. It might be one of the new savings aspects of the company.

Market concerns

The automotive industry has seen increased global consolidation over the past two years, The New York Times reported. According to industry analysts, the consolidation is fueled by three major trends: brands growing in importance, manufacturers forging into difficult markets, and rising costs of technology. While many industry experts see the consolidation as inevitable and strategically beneficial, some analysts warn excessive consolidation could lead to diminishing choices and higher prices for consumers.

The Daimler-Chrysler merger is one of the few examples when the merger benefits the competitiveness of the market. Chrysler Corporation manufactures lower-range trucks, minivans, and sport utilities, when Daimler-Benz majors in high-priced vehicles. No significant overlap in production will take place. Since both of the companies specialize in different areas, neither of them will have to give up on some of their production. “There was no real overlap in products –they filled in each other’s blank spaces” said David Cole, the head of the University of Michigan’s Office for the Study of Automotive Transportation. In turn, this meant that there will be no decrease in competition in the market place, which is one of the main concerns of the Federal Trade Commission when a merger takes place. (In a horizontal merger, the acquisition of a competitor could increase market concentration and increase the likelihood of collusion. The elimination of head-to-head competition between two leading firms may result in unilateral anticompetitive effects).

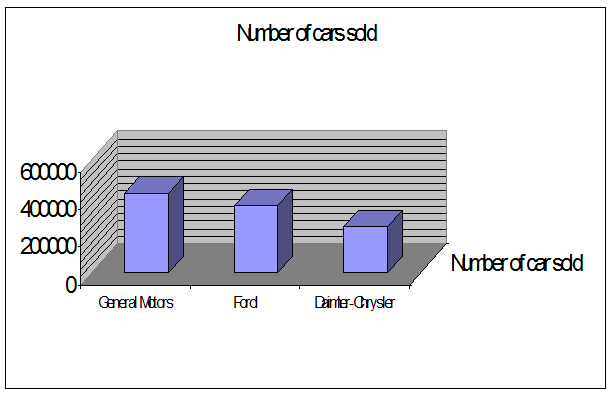

Another concern of The Federal Trade Commission and European Commission is the possibility of monopolization of the market. The automobile market is very large and diversified. For example, July 1999 car sales in the USA for the three largest companies are as shown on the graph:

Even after the merger, Daimler-Chrysler is not capable of keeping such a huge market under control. As one can see on the above chart, Daimler-Chrysler (243420 vehicles) is on the third place in production after General Motors (422029 vehicles) and Ford Motor Co. (355765 vehicles).

In the case of Chrysler Corporation and Daimler-Benz, the hazard of competition decrease does not exist, because the companies produce different types of cars. There would be a decrease of competition if after the merger, one of the companies would have to give up some of its production plans and eventually consumers would be hurt. Instead, it will just intensify competition in the car manufacturing world. On July 24 and July 31 of 1998, the European Commission and the Federal Trade Commission, respectively, approved the merger of Chrysler and Daimler-Benz Corporation, and appearance of Daimler-Chrysler. This merger is classified as a “horizontal merger.”

In order to become the largest car-producing corporation in the world, Daimler-Chrysler has to acquire or merger with some other companies, and this is in fact, what Daimler-Chrysler is looking at right now. On March 10, 1999, Daimler-Chrysler broke off talks about buying a stake in Nissan Motor of Japan, but it has not given up. On March 22, 1999, Schrempp held negotiations with Japan’s Mitsubishi Motors about a possible merger. As it can be seen, the new corporation very actively looks for partners in Asia, but the question that might rise soon will be whether the next merger will be approved by the Federal Trade Commission.

Another fact that might alert the US government is that on February 25, 2000, General Motors Corporation, Ford Motor Corp. and DaimlerChrysler jointly announced that they are planning to combine their efforts to form a business-to-business integrated supplier exchange through a single global portal. Some view this fact as a slow movement towards market monopolization.