Топик: Crisler Corporation. Senior thesis

German-American automaker DaimlerChryslter agreed on March 27, 2000, to buy a controlling 34% stake in Japan’ Mitsubishi Motors Corp. for 2.1 billion, extending its international reach.

The agreement gives DaimlerChrysler access to the Asian market and small-car expertise of Mitsubishi, Japan’s fourth-largest automaker. Carmakers are increasingly seeking cross-border alliances as overcapacity prompts them to cut costs through the sharing of parts and vehicle platforms with manufacturers in a range of markets.

DaimlerChrysler’s deal excludes Mitsubishi’s trucks division, which has an alliance with Sweden’s AB Volvo. Together DaimlerChrysler and Mitsubishi will have a combined market share of about 10.8% in Japan and 9.4% in other parts of the Asia-Pacific region. Daimler’s purchase gives it the right to veto board-level decisions at Mitsubishi.”[i]

New Corporation

Daimler-Chrysler provides a variety of transportation products and financial and other services. It operates seven business segments: passenger cars and trucks (Chrysler, Plymouth, Jeep, Dodge; 43% of 1998 sales), passenger cars (Mercedes-Benz, Smart; 23%), commercial vehicles (Mercedes-Benz, Freightliner, Sterling, Setra; 17%), aerospace (7%), services (6%), Chrysler financial services (2%), and other (2%).

Daimler-Chrysler Corporation is primarily active in Europe, North and South America and Japan and is continuing to expand in markets such as Eastern Europe and East and Southeast Asia (intensive negotiations with Asian companies are obvious evidences of that).

Another aspect of penetrating new markets is that developing new products, opening new stores and offices, hiring managers, and training stuff requires a lot of funds. There are two ways of raising these funds: internal and external. Internal funds come from Retained Earnings. External funds come from loans, bonds, issuance of common stock and other sources. The merger would increase the amount of money in Retained Earnings that could be used in an expansion program. Through the pooling of resources, DaimlerChrysler will be excellently placed to develop and introduce new products even more quickly into the markets, thus gaining an edge over competitors.

Achievements of the New Corporation

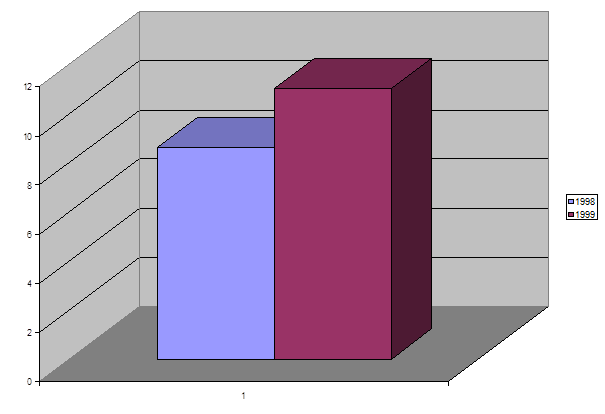

“DaimlerChrysler AG today reported a record operating profit of EUR 11.0/$11.1 billion in 1999, the company’s first full year of operations. This is an increase of 28% compared to the 1998 figure of EUR 8.6/$8.7 billion. Adjusted for one-time effects, principally the sale of debitel shares and restructuring expenses at Adtranz, operating profit grew by 20% to EUR 10.3/$10.4 billion. Operating profit thus outpaced revenues which rose by 14% to a record EUR 150.0/$151.0 billion.”

Recently, the German financial magazine “Capital” conducted a survey on the provision of shareholders’ information on the Internet. The overall winner was DaimlerChrysler, which was recognized as the best provider of company information on the Internet.

Survey of recent stock performance

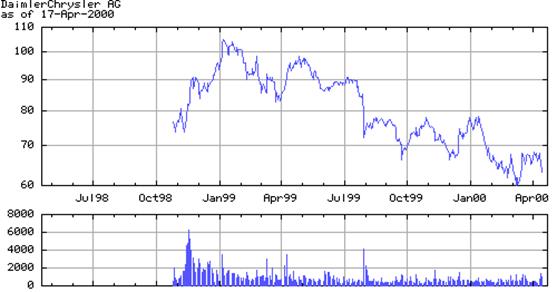

Immediately after the merger, the stock price of the new company went up very drastically. The reason for this is that investors strongly believe in the future success of DaimlerChrysler.

Currently, the stock price is down. This fact can be explained by the general performance of the market, which is experiencing very sudden slumps. Many huge companies do not trade at all out of fear of prices drop. Below is the chart of stock price performance of the DaimlerChrysler since the merger.

|

Below is a valuation of DaimlerChrysler by analysts at Standard & Poor’s.

“DCX has fallen sharply from its early 1999 peak. The automotive sector has been out of investor favor for some time, with DaimlerChrysler contributing to the negative sentiment with its much lower than expected earnings in the second quarter. Despite DCX’s attempt to portray the divergence from expectations as mostly accounting and temporary items, the honeymoon for investors and DaimlerChrysler is clearly over. DaimlerChrysler has a strong balance sheet, with significant cash reserves available for the next industry downturn, as well as for strategic investments and alliances. With strong sales through September, we expect 1999 domestic automotive volume, led by minivans and sport utility vehicles, DCX strengths, to reach a record. Still, given negative investor sentiment and uncertainty in the company’s ability to meet financial objectives, despite a strong third quarter, we would not add to positions.”[ii]

Comments on some of the Financial Ratios of the New Corporation

As the ratios reveals new corporation by some of the ratios overcome industry average. Valuation ratios show us DaimlerChrysler is in better standing in comparison with the industry. Dividends payout ratio proves that the company pays more dividends than average, but I think it is not what investors expected and this lead to a drop in price of the stock.

Financial strength of the company in terms of LT Debt to Equity and Total Debt to Equity ratios is almost twice stronger than the average in the industry. Low return on Equity ratio might be explained by the fact that the company keeps a lot of cash for the purpose of new investment. In general, the company shows strong figures and this view is supported by Standards & Poor’s specialists’ statement. “DaimlerChrysler has a strong balance sheet, with significant cash reserves available for the next industry downturn, as well as for strategic investments and alliances.”[iii]

Government Concerned that...

One of the problems that can arise for the economies of the US and Germany is downsizing of some of the departments. For example, one company does not need two raw material purchase departments. In this case, the new company will need both of its departments because of different languages. The new company will provide more job opportunities for both countries. There are two reasons why this might be so:

1) Expansion plans will require more people to be hired for the new company

2) Because of different languages, much of the documentation has to be translated back and forth.

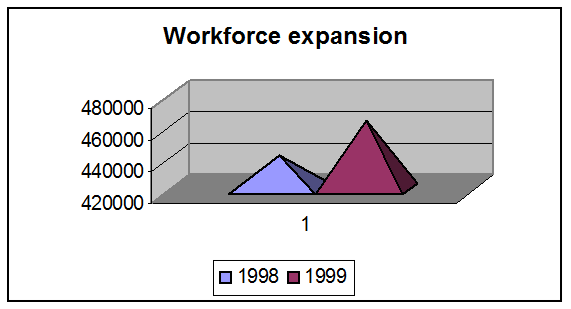

This figure shows expansion so far:

|

Since both companies are introduced to new markets and new opportunities, they will have to increase their production capacities in order to meet demand in the new market. This factor will require more labor ( as can be seen from the above graph), so more people will be hired. Government does its best to support companies that can provide more employment opportunities for the population, because this contributes to the solution to the unemployment problem. Simultaneously, with the increase of labor involved in the production process, there will be an increase in gross domestic product.

Environmental Issues in the New Corporation

Protection of the surrounding environment and conserving the natural foundations of life should be one of the main concerns of every company and every human being on the Earth. Due to lack of attention to these issues the current environment conditions of the earth have changed dramatically for the worse.

DaimlerChrysler is one of the world corporations that pays a great deal of attention to environmental issues. Its management clearly understands the importance of these issues in the long run. The following facts speak up for themselves:

“DaimlerChrysler and the European Nature Heritage Fund (Euronatur) presented an upbeat review of ten years of environmental cooperation at a press conference in Berlin today. "The concerted efforts of DaimlerChrysler and Euronatur have decisively moved forward environmental protection and habitat security in important large natural landscapes," a joint statement said.[iv]

“On March 29, 2000, DaimlerChrysler’s manufacturing facility in Toluca, Mexico, introduced to production a new wastewater recycling facility. The recycling facility will conserve precious water resources and reduce the potential for pollution by totally recycling all of the water used in the plant.”

In 1998, DaimlerChrysler spent $1.3 billion on environmental protection, according to the company’s Annual Environmental Report. Most of this amount (about $813 million) was spent on research and development activities on green products and manufacturing processes.[v]

Conclusion

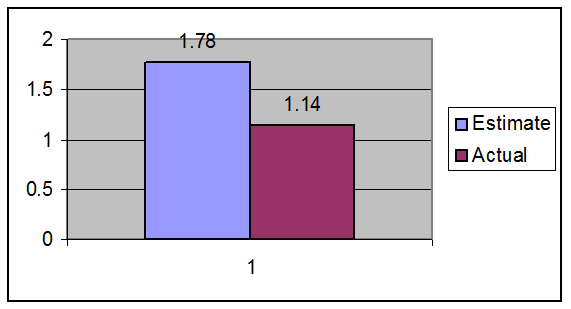

There is only one thing can be said about the future of the new company—it is unclear. As one can see throughout the research, firstly after the merger investors strongly believed in the future of DaimlerChrysler, and as a result of that the stock price soared high. Recently the stock price has dropped significantly, but some believe that it is because entire market experiences slumps. As seen on the prior chart of the stock performance, DaimlerChrysler’s stock price lost 1/3 of its value. Another reason why the stock price slumps is that estimated earnings did not match actual ones. As a December 1999, difference in estimated and actual earning was ($0.64).[vi]

One of the positive aspects of the merger is intensified competition in the auto-production industry. The new company is far from monopolist size in this very giant market. General Motors and Ford Corporation are still main competitors of DaimlerChrysler.

Bibliography

[i] London CNN, http://CNNfn.com/, Monday, 27 March, 2000