Топик: Financial Planing

Unit 4

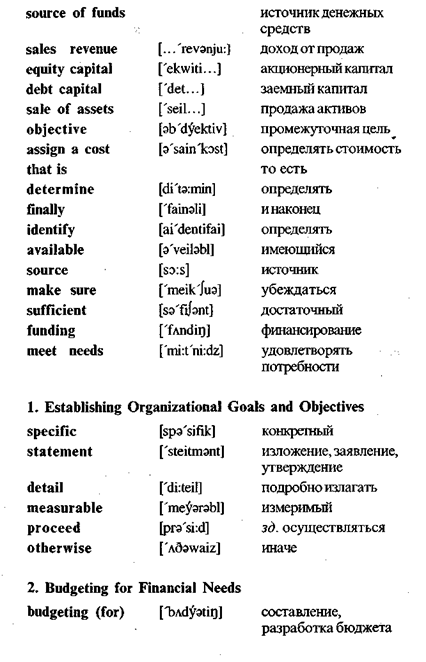

Financial planning (like all planning) begins with the establishment of goals and objectives. Next, planners must assign costs to these goals and objectives. That is, they must determine how much money is needed to accomplish each one. Finally, financial planners must identify available sources of financing and decide which to use. In the process, they must make sure that financing needs are realistic and that sufficient funding is available to meet those needs.

THREE STEPS OF FINANCIAL PLANNING

1. Establishing Organizational Goals and Objectives. Establishing goals and objectives is an important management task. A goal is an end state that the organization wants to achieve. Objectives are specific statements detailing what the organization intends to accomplish within a certain period of time. If goals and objectives are not specific and measurable, they cannot be translated into costs, and financial planning cannot proceed. They must also be realistic. Otherwise, it may be impossible to finance or achieve them.

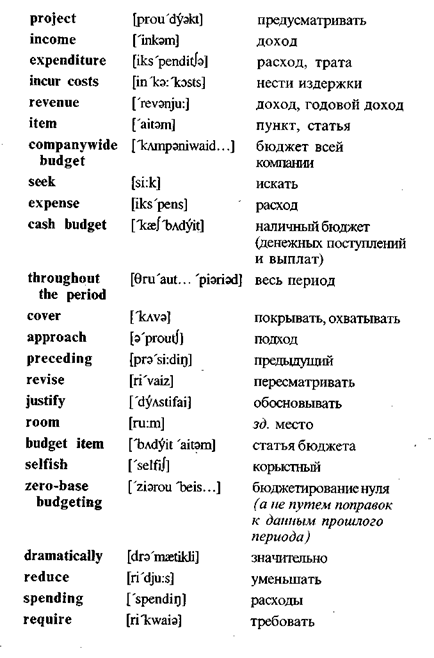

2. Budgeting for Financial Needs. A budget is a financial statement that projects income and/or expenditures over a specified future period of time. Once planners know what the firm's goals and objectives are for a specific period of time - say, the next calendar year- they can estimate the various costs the firm will incur and the revenues it will receive. By combining these items into a companywide budget, financial planners can determine whether they must seek additional funding from sources outside the firm.

Usually the budgeting process begins with the construction of individual budgets for sales and for each of the various types of expenses: production, human resources, promotion, administration, and so on. Budgeting accuracy is improved when budgets are first constructed for individual departments and for shorter periods of time. These budgets can easily be combined into a com-

panywide cash budget. In addition, departmental budgets can help managers monitor and evaluate financial performance throughout the period covered by the overall cash budget.

Most firms today use one of two approaches to budgeting. In the traditional approach, each new budget is based on the dollar amounts contained in the budget for the preceding year. These amounts are modified to reflect any revised goals, and managers must justify only new expenditures. The problem with this approach is that it leaves room for the manipulation of budget items to protect the (sometimes selfish) interests of the budgeter or his or her department.

This problem is essentially eliminated through zero-base bud geting.

Zero-base budgeting is a budgeting approach in which every expense must be justified in every budget. It can dramatically reduce unnecessary spending. However, some managers feel that zero-base budgeting requires too much time-consuming paperwork.

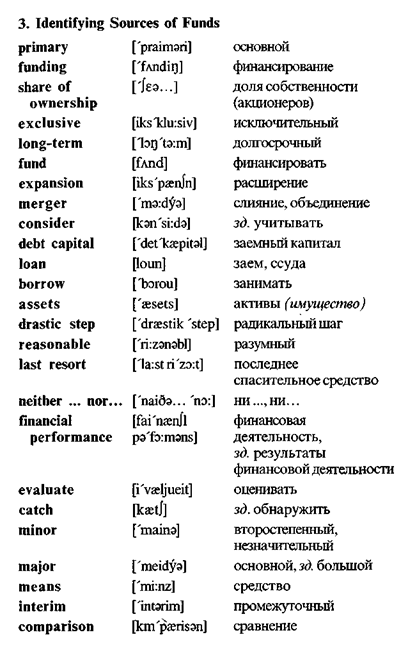

3. Identifying Sources of Funds. The four primary sources of funds are sales revenue, equity capital, debt capital, and the sale of assets. Future sales generally provide the greatest part of a firm's financing.

Sales revenue is the first type of funding.

The second type of funding is equity capital, which is money received from the sale of shares of ownership in the business. Equity capital is used almost exclusively for long-term financing. Thus it might be used to start a business and to fund expansions or mergers. It would not be considered for short-term financing needs.

The third type of funding is debt capital, which is money obtained through loans. Debt capital may be borrowed for either short- or long-term use.

The fourth type of funding is the sale of assets. A firm generally acquires assets because it needs them for its business operations. Therefore, selling assets is a drastic step. However, it may

|

|

be a reasonable last resort when neither equity capital nor debt capital can be found. Assets may also be sold when they are no longer needed.

MONITORING AND EVALUATING FINANCIAL PERFORMANCE

It is important to ensure that financial plans are being implemented and to catch minor problems before they become major problems. Accordingly, the financial manager should establish a means of monitoring and evaluating financial performance. Interim budgets (weekly, monthly, or quarterly) may be prepared for comparison purposes. These comparisons point up areas that require additional or revised planning.

|

|

|

|

Exercises

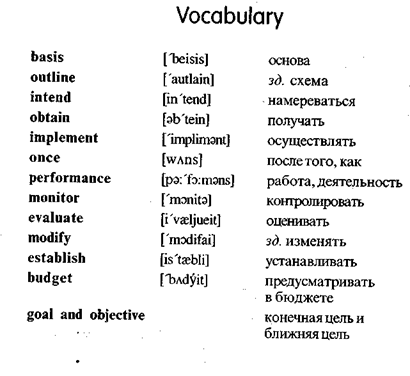

I. Translate into Russian.

Basis of financial management; goal; objective; sources of fi

nancing; funding; step; important task; financial performance;

budgeting; expenditure; revenue; sales revenue; equity capital;

debt capital; specific period; profit; assets; short-term borrowing;

long-term borrowing; merger; companywide budget; cash budget;

zero-base budgeting; income; source; share of ownership; assign

a cost; justify; meet needs; obtain; implement; modify; establish;

reduce; determine; evaluate. !:

II. Find the English equivalents. \

Финансовый план; бюджет; составление бюджета; наличный бюджет; бюджет всей компании; промежуточный бюджет; доход (годовой); доход; доход от продаж; заемный капитал; работа фирмы; активы; бюджетная статья; расход; источник денежных средств; доля собственности; акционерный капитал; средство; последнее спасительное средство; радикальный шаг; финансовая деятельность; определять стоимость; решать; оценивать; оправдывать; осуществлять; удовлетворять потребности; нести издержки; финансировать; занимать (брать в долг).

III. Fill in the blanks.

1. Financial planning begins with the establishment of ... and

2. A budget is a financial statement that projects ... and/or ... over a specified future period of time.

--> ЧИТАТЬ ПОЛНОСТЬЮ <--