Топик: Financial Planing

9. Why do manufacturers often need short-term financing?

10. For what purpose (цель) is the borrowed money often used by the manufacturers?

11. When is the borrowed money usually repaid?

12. What is long-term financing? , .:

13. For what purpose is long-term financing needed?

14. Are the amounts of long-term financing greater than those of short-term financing?

VI. Make up a written abstract of the above text.

VII. Retell the prepared abstract.

Unit 6

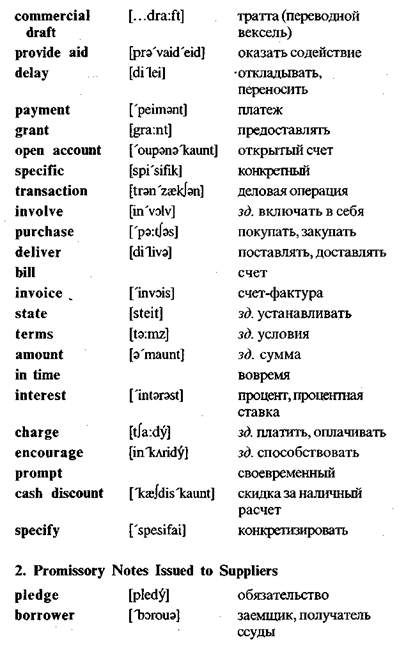

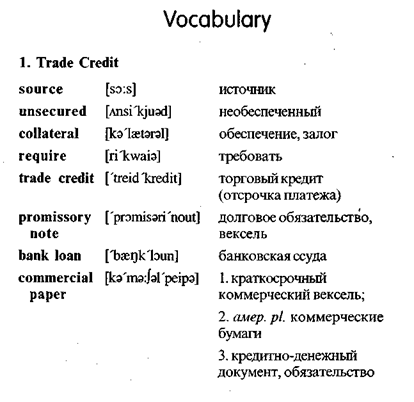

Sources of Unsecured Financing

Unsecured financing is financing for which collateral is not required. Most short-term financing is unsecured. Sources of unsecured short-term financing include trade credits, promissory notes, bank loans, commercial papers, and commercial drafts.

1. TRADE CREDIT

Wholesalers may provide financial aid to retailers by allowing them thirty to sixty days (or more) in which to pay for merchandise. This delayed payment, which may also be granted by manufacturers, is a form of credit known as trade credit or the open account. More specifically, trade credit is a payment delay that a supplier grants to its customers.

Between 80 and 90 percent of all transactions between businesses involve some trade credit. Typically, the purchased goods are delivered along with a bill (or invoice) that states the credit terms. If the amount is paid on time, no interest is generally charged. In fact, the seller may offer a cash discount to encour-. age prompt payment. The terms of a cash discount are specified on the invoice.

2. PROMISSORY NOTES ISSUED TO SUPPLIERS

A promissory note is a written pledge by a borrower to pay a certain sum of money to a creditor at a specified future date. Unlike trade credit, however, promissory notes usually require the borrower to pay interest. Although repayment periods may extend to one year, most promissory notes specify 60 to 180 days. The customer buying on credit is called the maker and is the party that

issues the note. The business selling the merchandise on credit is called the payee.

A promissory note offers two important advantages to the firm extending the credit. First, a promissory note are negotiable instruments that can be sold when the money is needed immediately.

3. UNSECURED BANK LOANS

Commercial banks offer unsecured short-term loans to their customers at interest rates that vary with each borrower's credit rating. The prime interest rate (sometimes called the preference rate) is the lowest rate charged by a bank for a short-term loan. This lowest rate is generally reserved for large corporations with excellent credit ratings. Organizations with good to high credit ratings may have to pay the prime rate plus 4 percent. Of course, if the banker feels loan repayment may be a problem, the borrower's loan application may be rejected.

Banks generally offer short-term loans through promissory notes. Promissory notes that are written to banks are similar to those discussed in the last section.

4. COMMERCIAL PAPER

A commercial paper is a short-term promissory note issued by a large corporations. A commercial paper is secured only by the reputation of the issuing firm; no collateral is involved. It is usually issued in large denominations, ranging from $5,000 to $100,000. Corporations issuing commercial papers pay interest rates slightly below those charged by commercial banks. Thus, issuing a commercial paper is cheaper than getting short-term financing from a bank.

Large firms with excellent credit reputations can quickly raise large sums of money. They may issue commercial paper totaling millions of dollars. However, a commercial paper is not without risks. If the issuing corporation later has severe financing problems, it may not be able to repay the promised amounts.

|

|

5. COMMERCIAL DRAFTS

A commercial draft is a written order requiring a customer (the drawee) to pay a specified sum of money to a supplier (the drawer) for goods or services. It is often used when the supplier is insure about the customer's credit standing.

In this case, the draft is similar to an ordinary check with one exception: The draft is filled out by the seller and not the buyer. A sight draft is a commercial draft that is payable on demand -whenever the drawer wishes to collect. A time draft is a commercial draft on which a payment date is specified. Like promissory notes, drafts are negotiable instruments that can be discounted or used as collateral for a loan.

|

|

|

К-во Просмотров: 1935

Бесплатно скачать Топик: Financial Planing

|